ShopBase Marketplace Payments - our internal payment gateway - helps reduce the risk of blocked accounts and pending payment. This payment gateway supports 03 countries in the world with numerous superior features for your e-commerce stores. In this section, we will guide you through all the basic features of ShopBase Marketplace Payments so you can optimize your store management.

In this article

B. Setting up ShopBase Marketplace Payments

C. Getting paid with ShopBase Marketplace Payments

F. ShopBase Marketplace Payments profit

A. Supported countries

Once ShopBase Marketplace Payments is available in your country, you’ll be able to accept payments from customers everywhere around the world.

Here's the list of supported countries that ShopBase Marketplace Payments is available.

B. Setting up ShopBase Marketplace Payments

When setting up ShopBase Marketplace Payments, you will need to provide the following information:

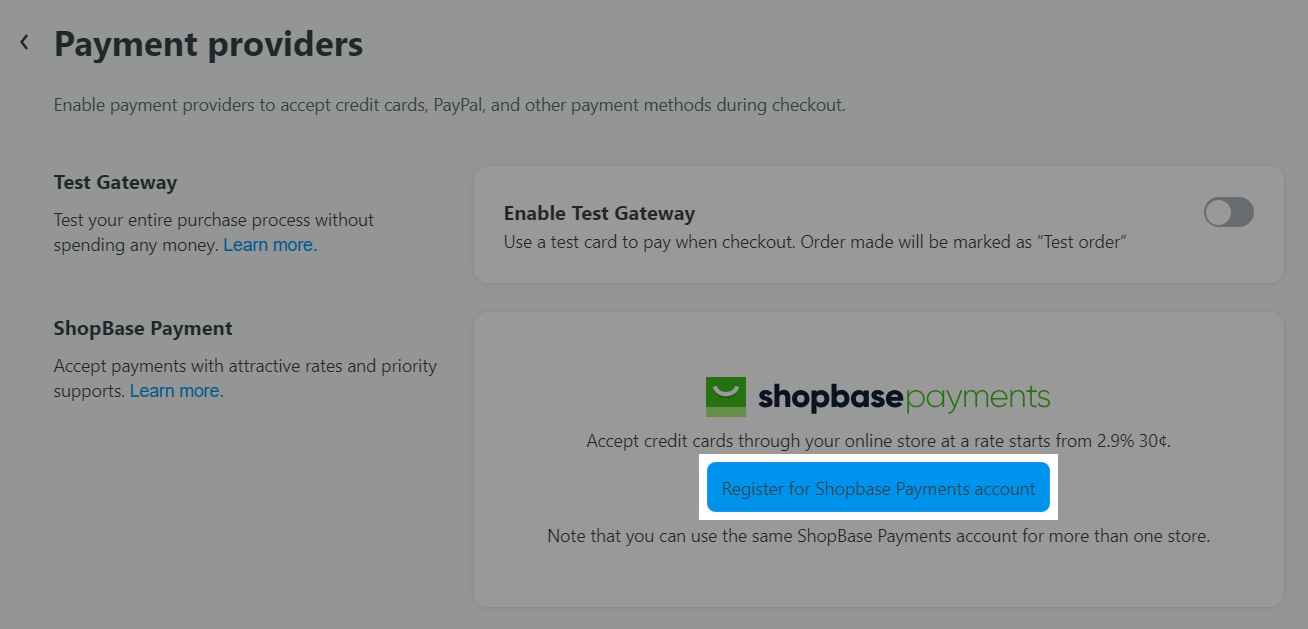

Step 1: From ShopBase Admin site > Go to Settings > Payment Providers > Register for ShopBase Payments account.

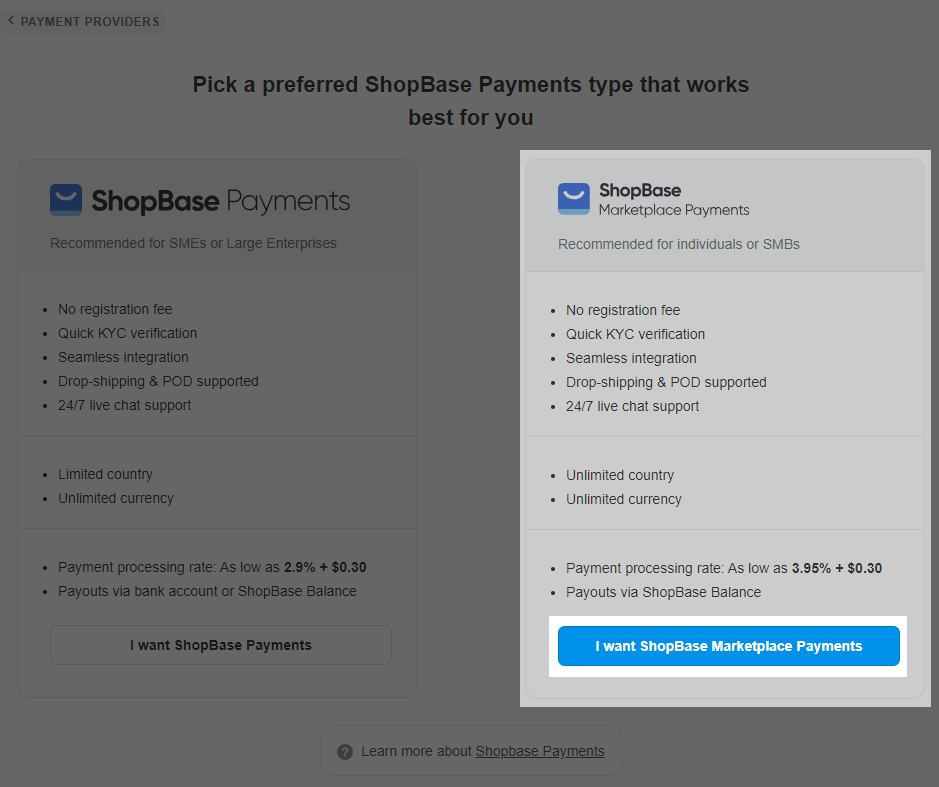

Then, cick on I want ShopBase Marketplace Payments.

Step 2: Fill in the KYC form to sign up for a ShopBase Marketplace Payments account.

Please refer to this article on how to fill in ShopBase Marketplace Payments registration form.

Step 3: After you complete this form, click Complete account setup.

Your KYC form will be reviewed by our ShopBase team. If you have any inquiries regarding your application, please contact us via LiveChat for further support.

Depending on each specific country and package, merchants will need to pay the corresponding processing fee. For more details, please go to your ShopBase admin site > Settings > Account.

ShopBase doesn’t charge your sales taxes and you will need to handle this by yourself. You should always check with a local tax authority or a tax accountant to make sure you file and remit the taxes correctly.

C. Getting paid with ShopBase Marketplace Payments

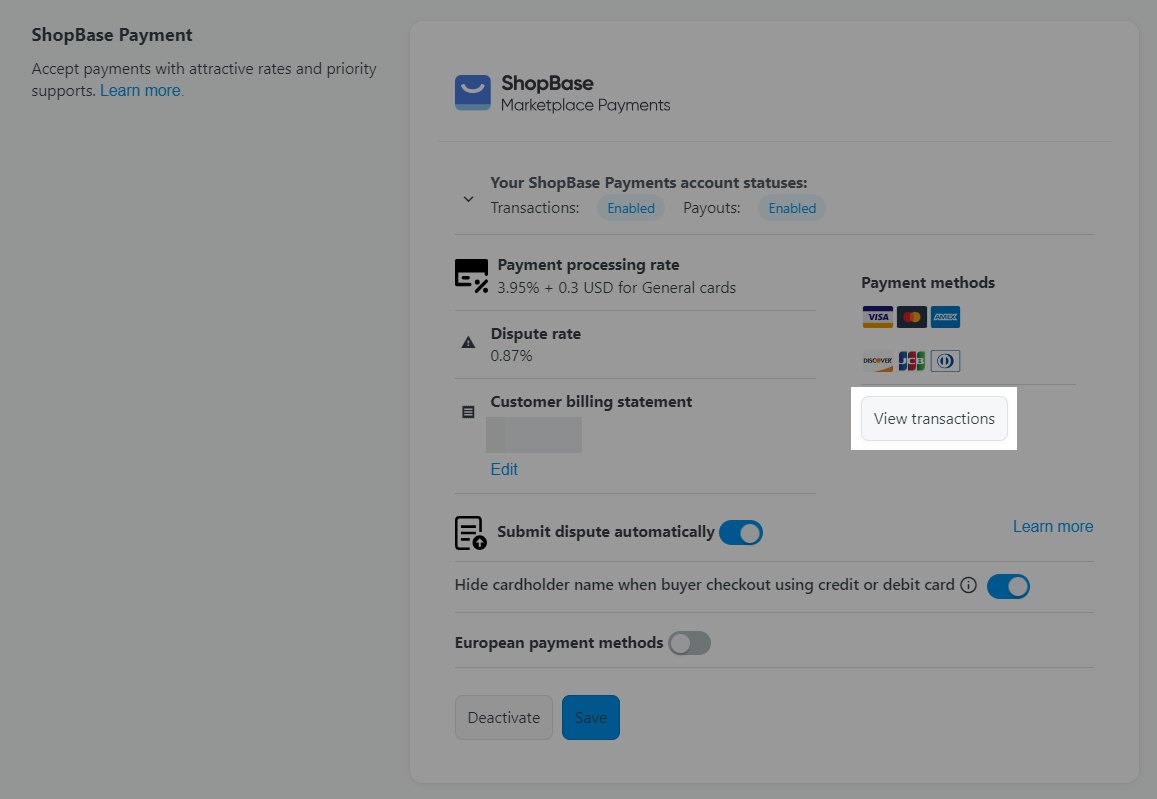

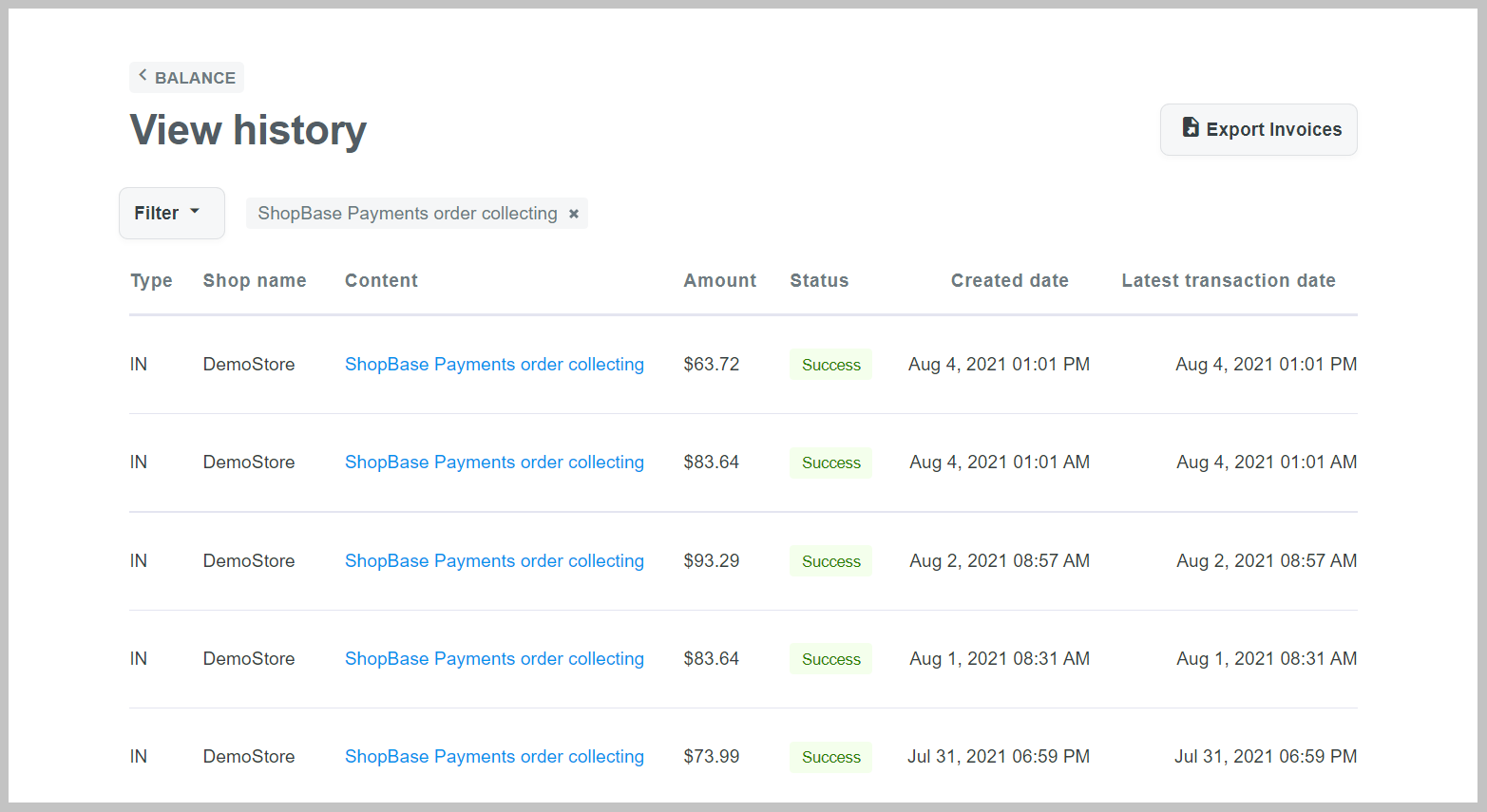

You can easily view your payouts by going to + > Settings > Payment Providers > Click on ShopBase Marketplace Payments > View Balance.

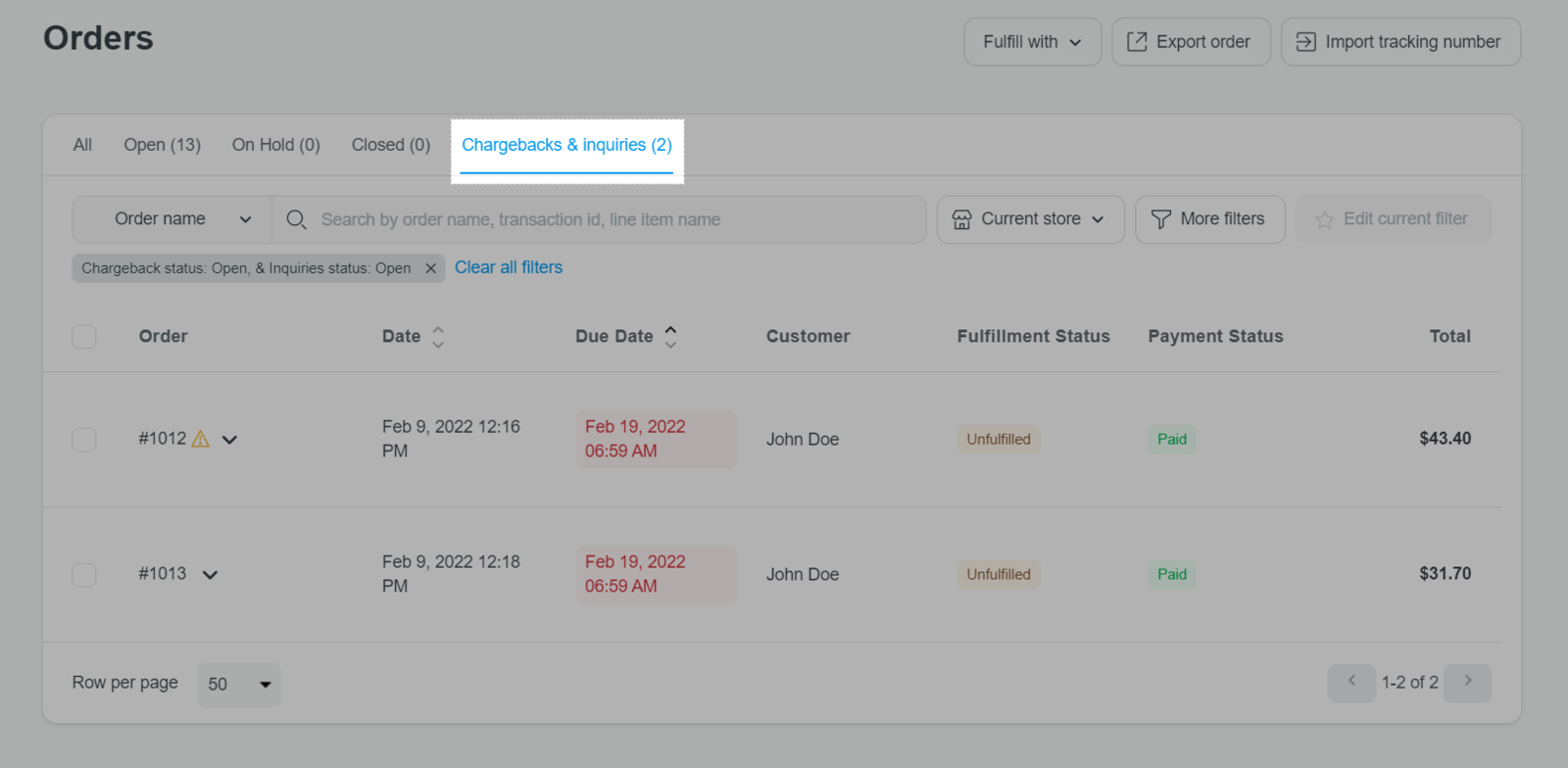

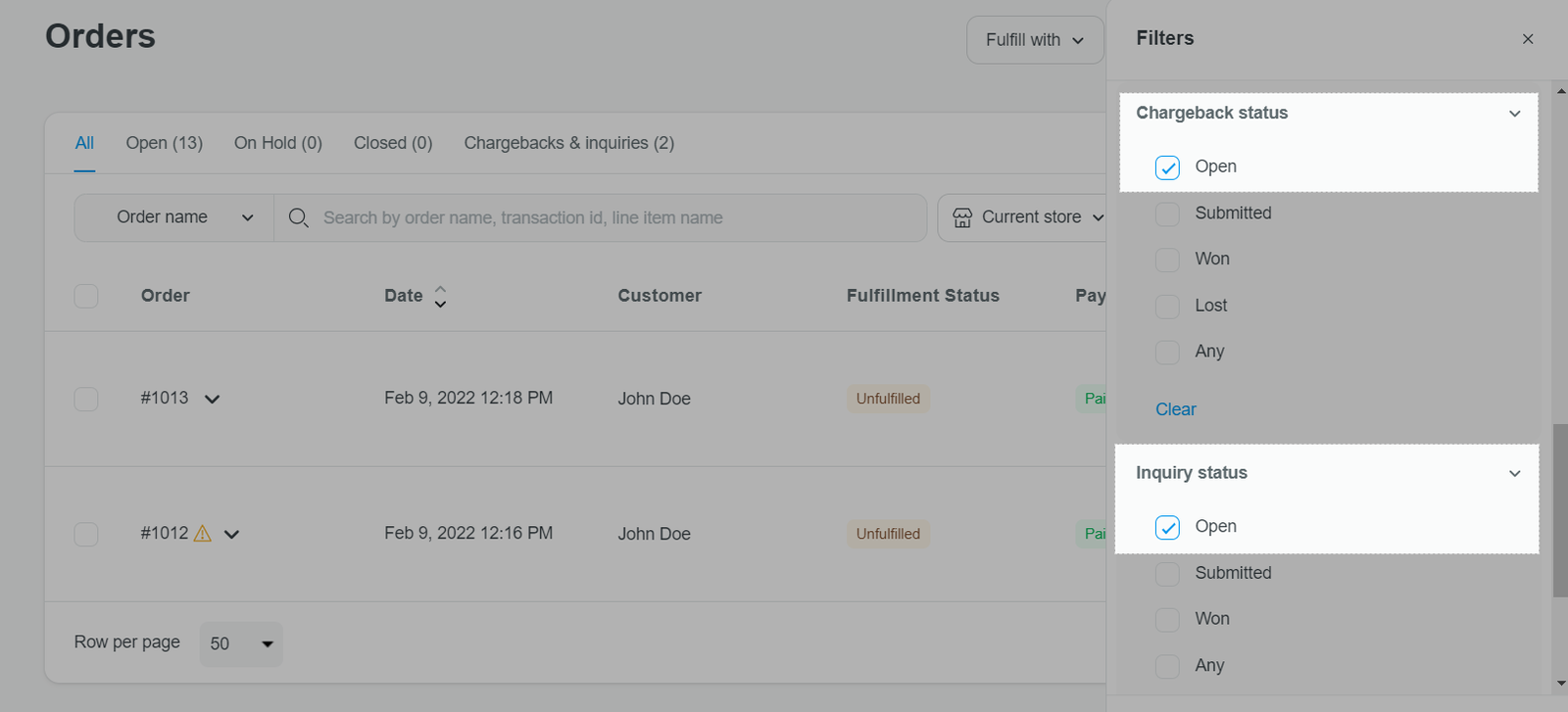

You can also refer to this article on how to filter out orders with chargeback or inquiry separately according to their statuses.

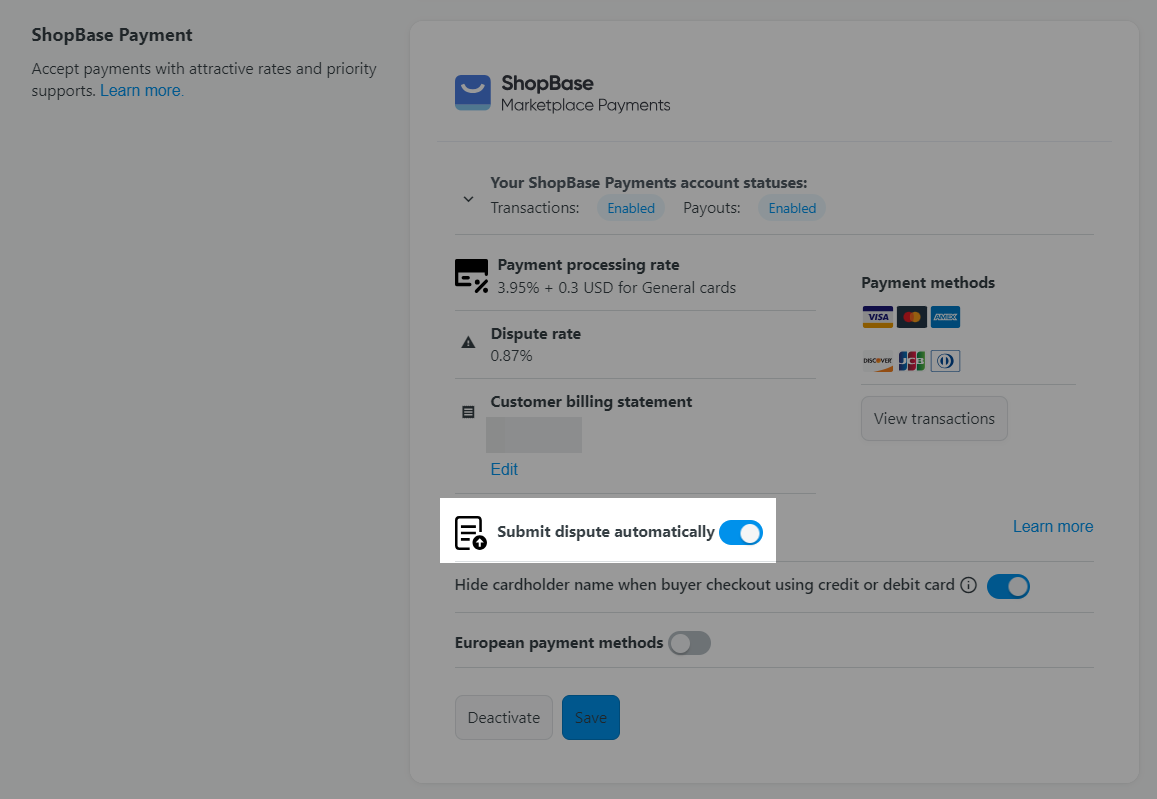

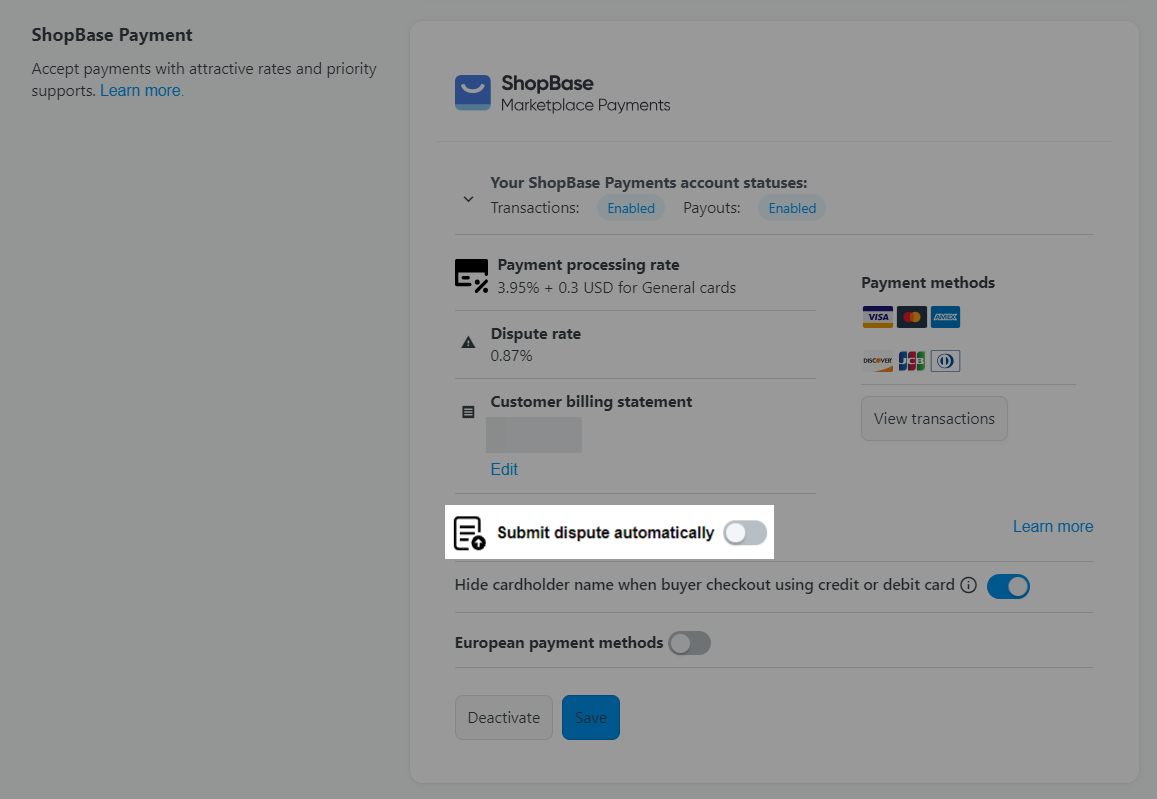

To automatically submit a chargeback /inquiry response

This setting is default for all stores with ShopBase Marketplace Payments.

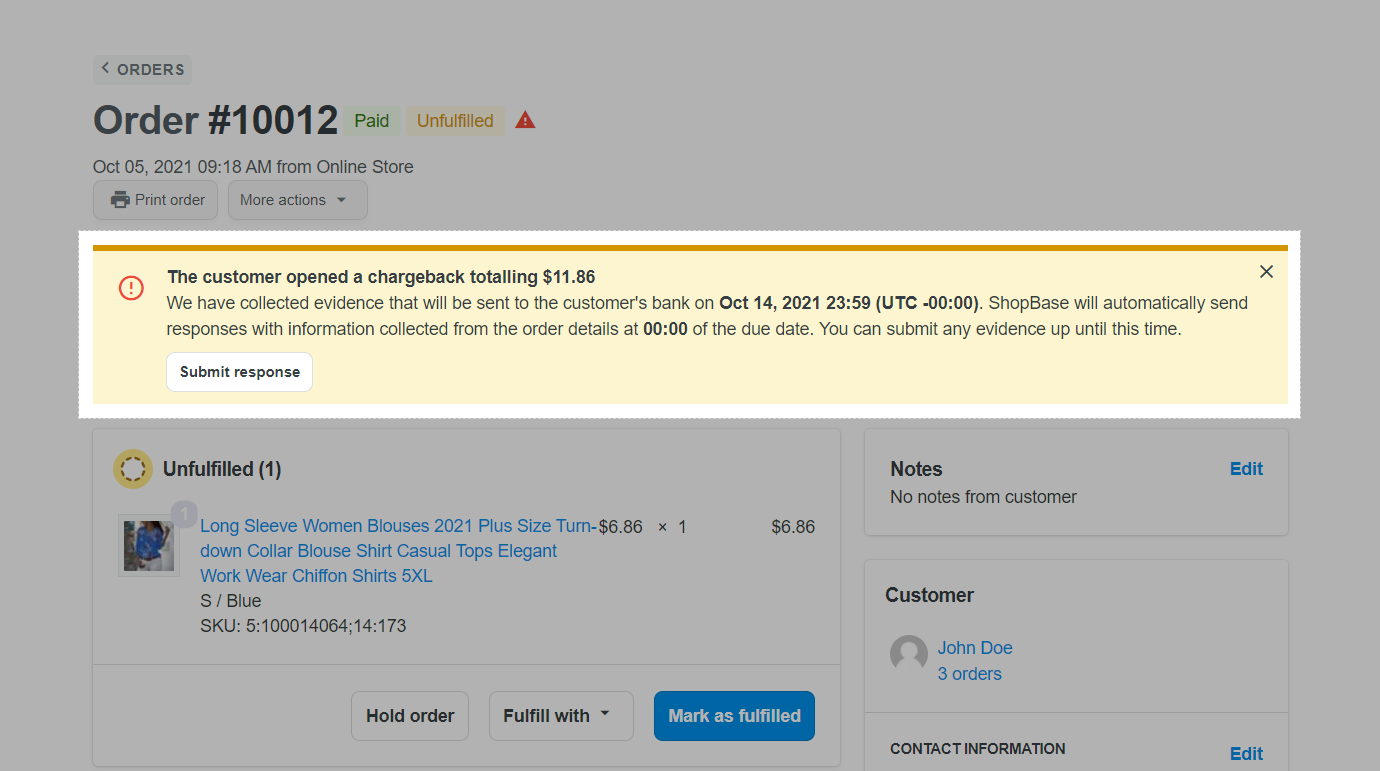

When this option is enabled, our system will automatically send responses with information collected from the order details at 0:00 A.M (UTC -0:00) of the due date. You have until this deadline to edit all evidences and manually submit responses beforehand upon your wish

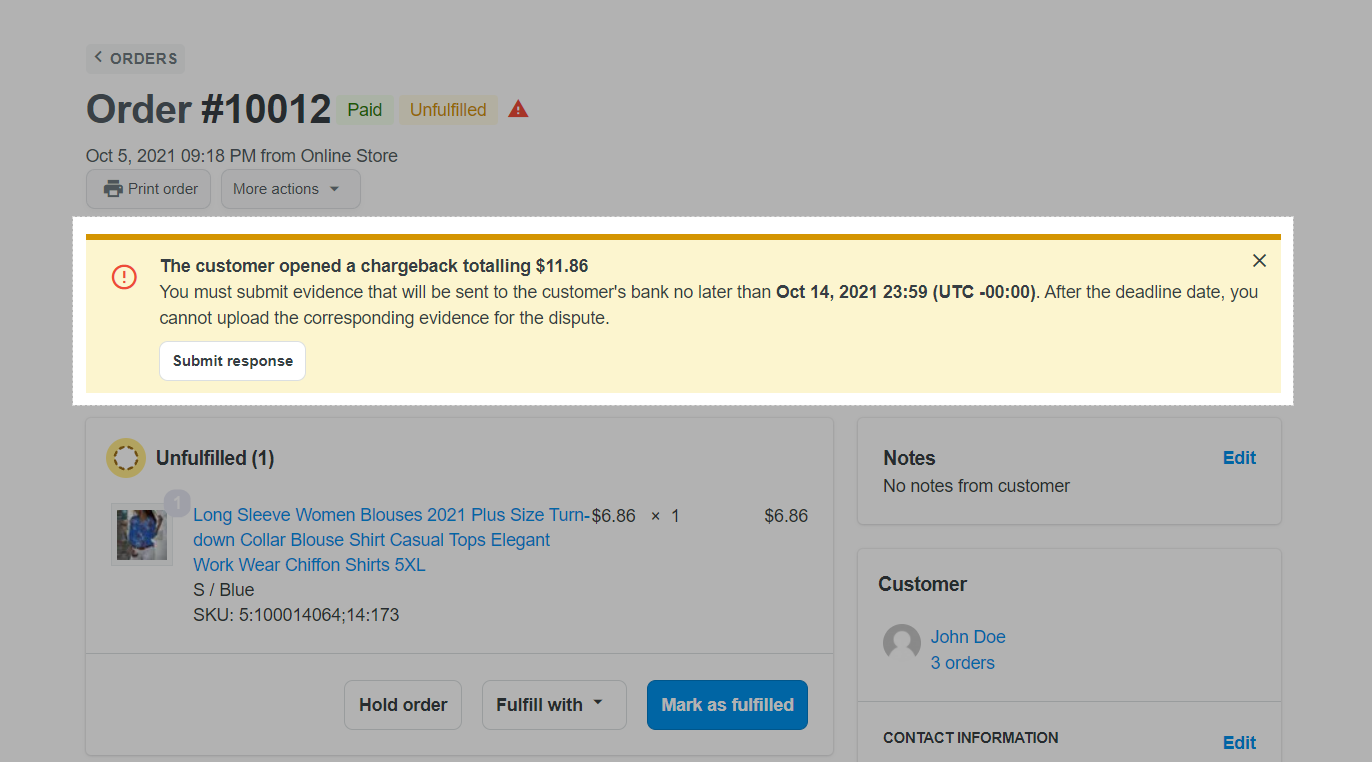

To manually submit a chargeback/inquiry response

If the deadline is overdue and no chargeback/inquiry response is submitted, it is likely that the dispute will be lost. Therefore, please be aware of this so that you can submit your response on time.

You can learn more about how to respond to your chargeback/inquiry requests in this article and how to submit a chargeback/inquiry response from your ShopBase admin site in this article.

D. Chargeback fee

When a chargeback request is opened, merchants will be temporarily charged the order value and a chargeback fee of $15 from your current available balance.

E. Supported currencies

Payout currency will be set up in KYC form while signing up for a ShopBase Marketplace Payments account.

F. ShopBase Marketplace Payments profit

Your ShopBase Marketplace Payments profit will be calculated by the following formula:

The payment processing rate (also known as application fee) applied for all ShopBase Marketplace Payments users is 3.95% + $0.3.

If your customers pay for orders by international cards (card's issuing country is different from your account's country), an additional 1% fee will apply per transaction.