ShopBase's taxes reports can provide a summary of sales taxes that were applied to your sales in the selected timeframe. You can export this report as a CSV file to help with your sales tax reporting. In this article, we will give you more details about ShopBase taxes reports.

Step by Step Tutorial

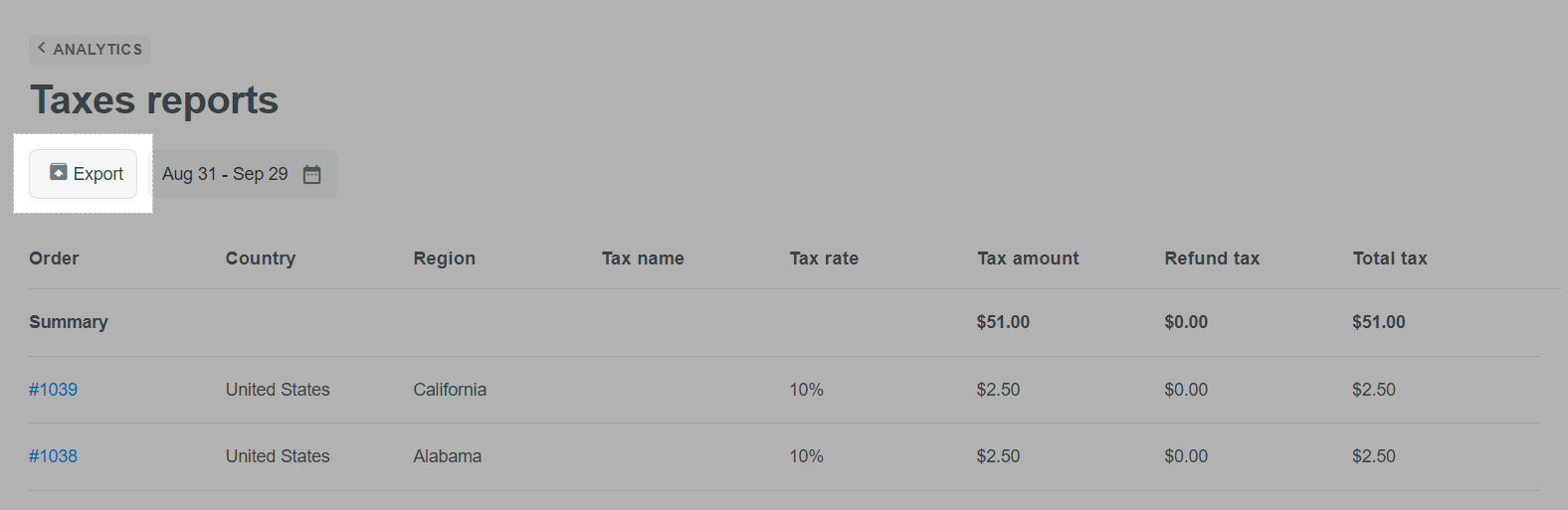

From your ShopBase admin site, go to Analytics > Taxes reports.

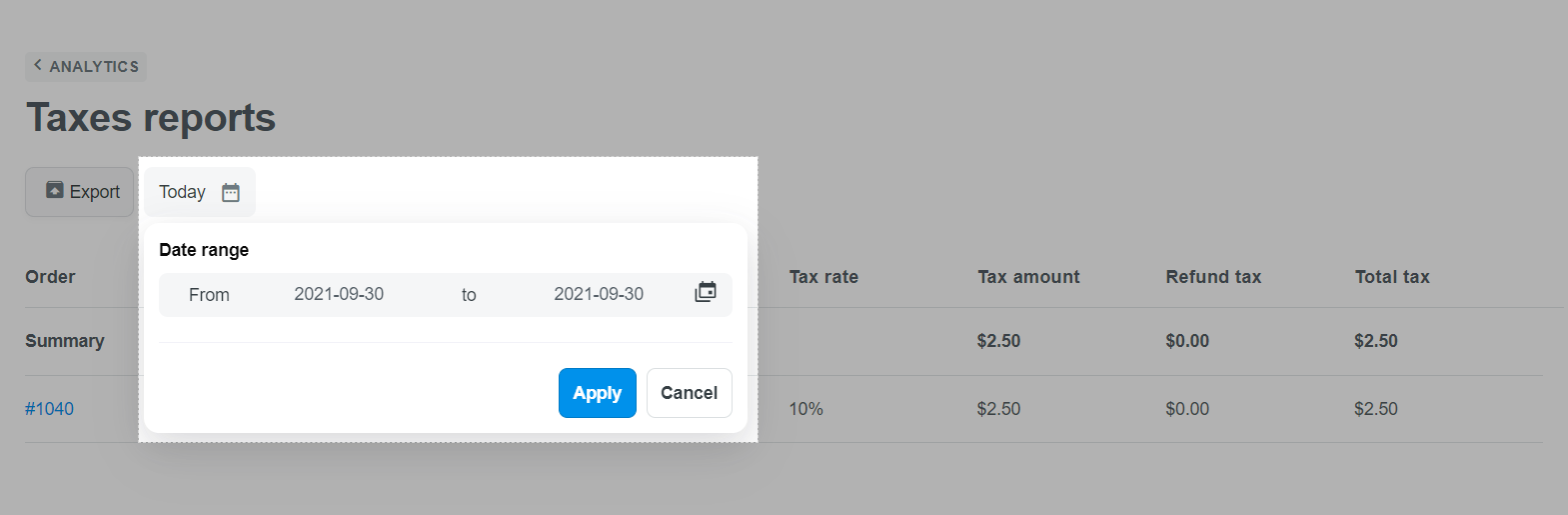

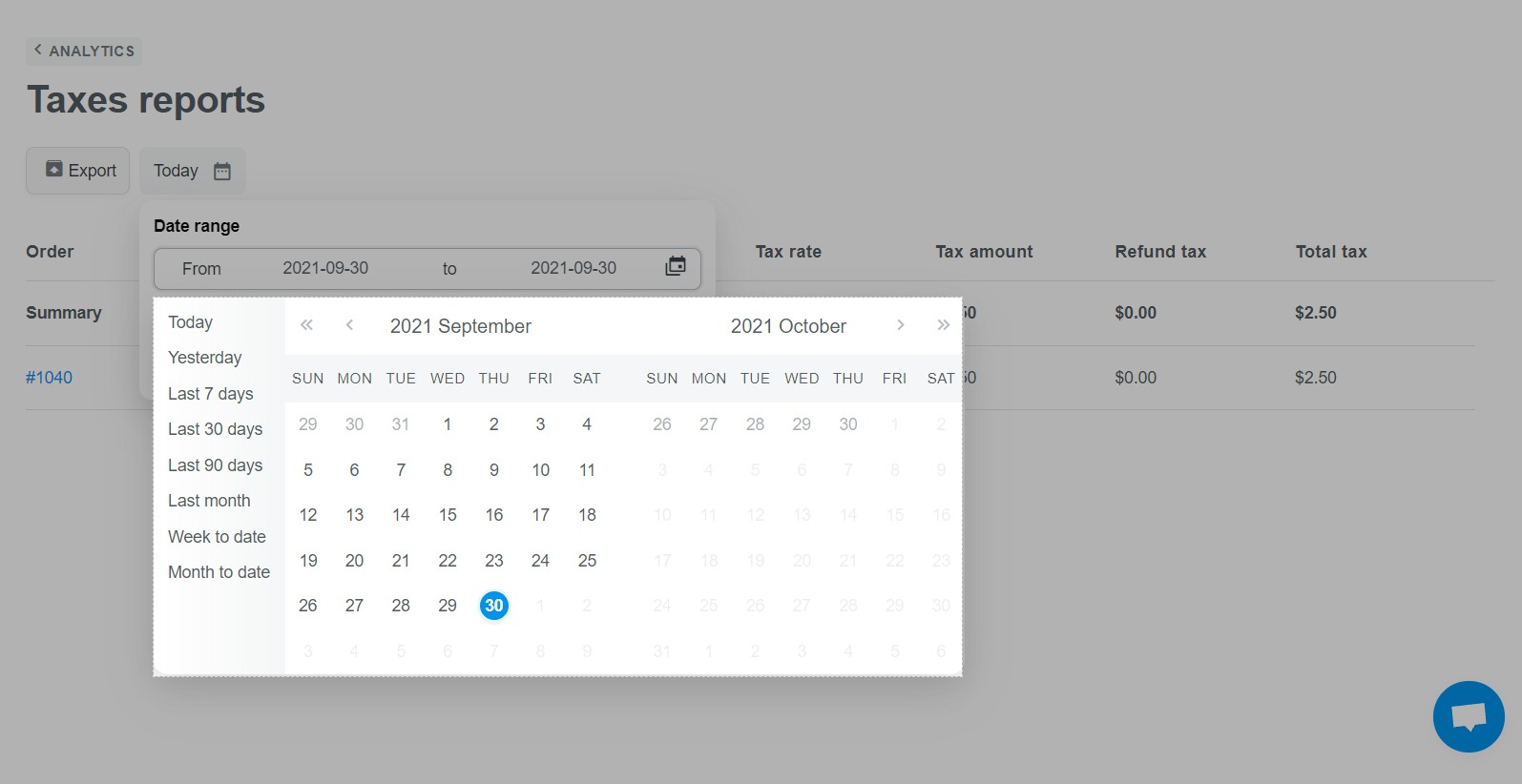

By default, the Taxes reports page shows today's data. If you want to see data of a different time period, click Today then click the date as shown below and choose a date range you want, such as last 7 days, or you can set the Custom time by clicking on the date on the calendar. After selecting the time period to view taxes reports, press Apply.

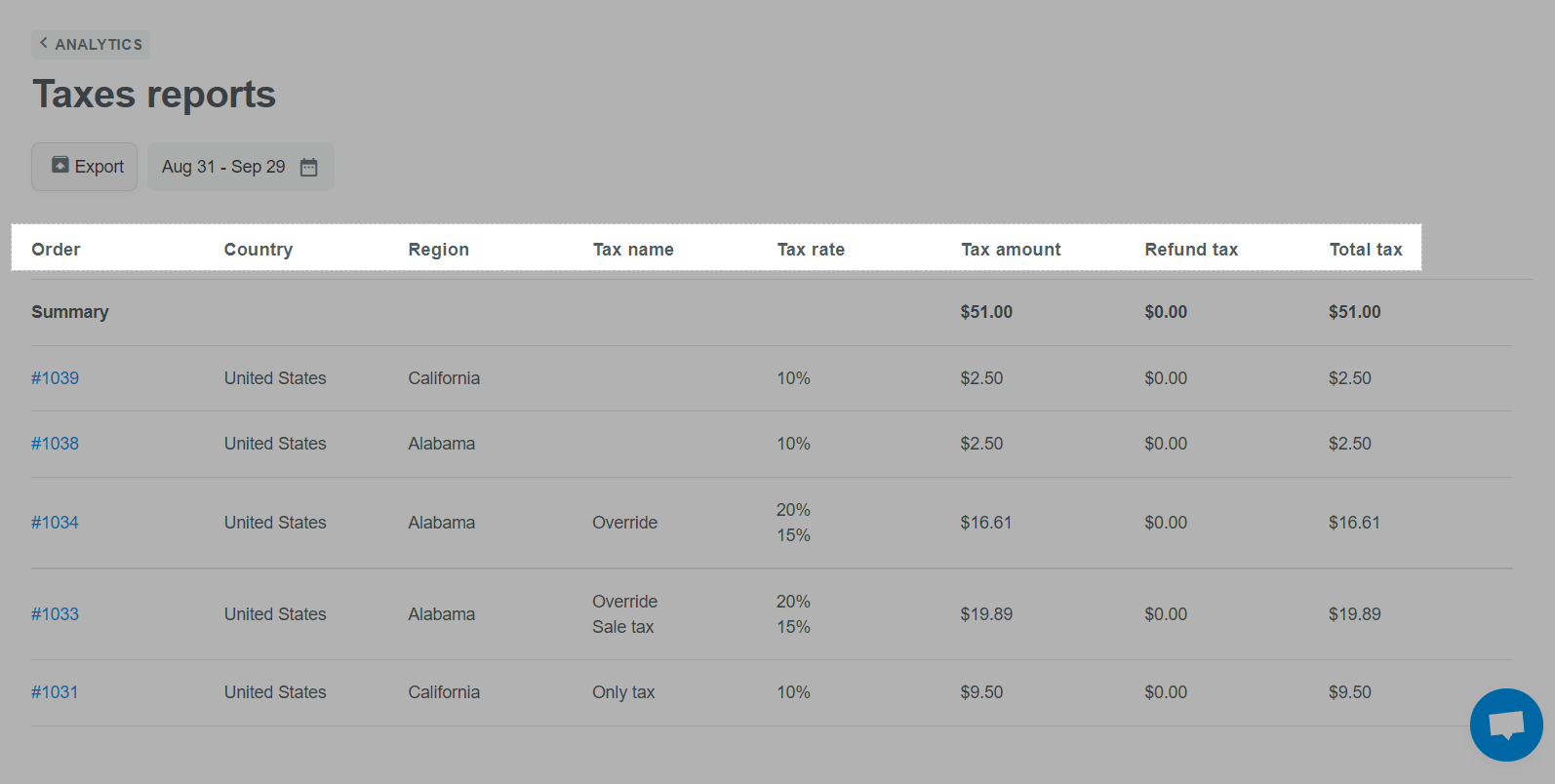

The Taxes reports will show:

Order: Name of order that collects tax.

Country: Destination country of the order that collects tax.

Region: Destination region of the order that collects tax.

Tax name: Name of the collected tax.

Tax rate: Percentage of collected tax.

Tax amount: Tax value collected.

Refund tax: Refunded tax amount of each order (if any). If there is no refund, the value will be displayed as $0.00.

Total tax = Total tax amount - Refund tax.

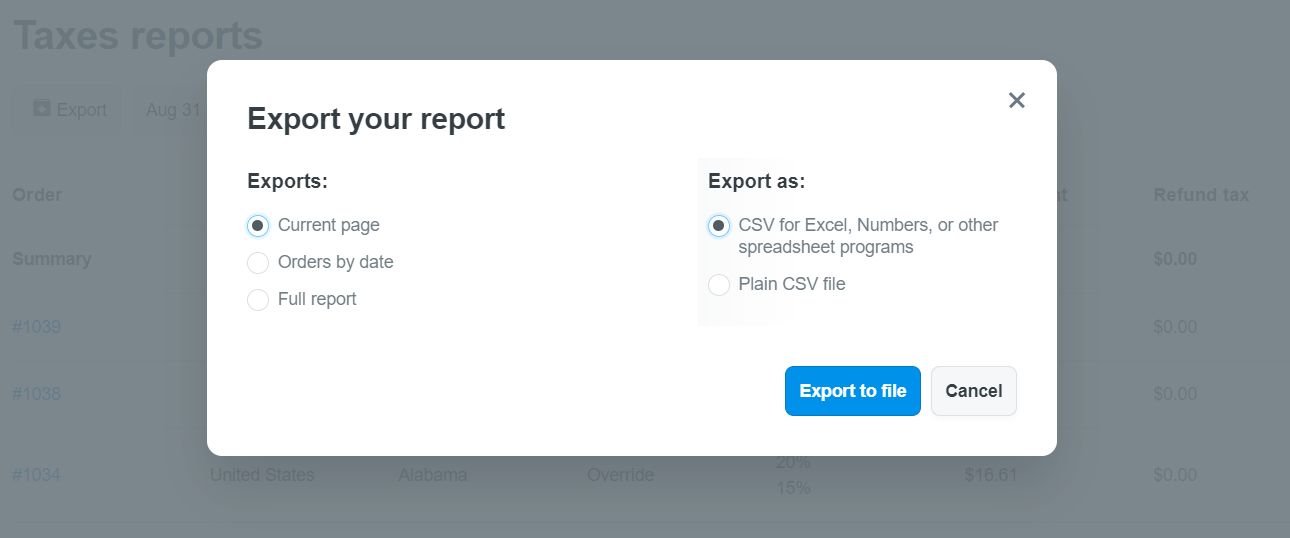

Select Export to export your taxes report to a CSV file.

In the pop-up, select:

Current page to export taxes reports for orders on current page.

Orders by date and filter the timeframe of orders you want to export.

Full report to export taxes reports for all orders of your store.